how much state tax is deducted from the paycheck

Yes Georgia residents do pay personal income tax. Your employer pays an additional 145 the employer part of the Medicare tax.

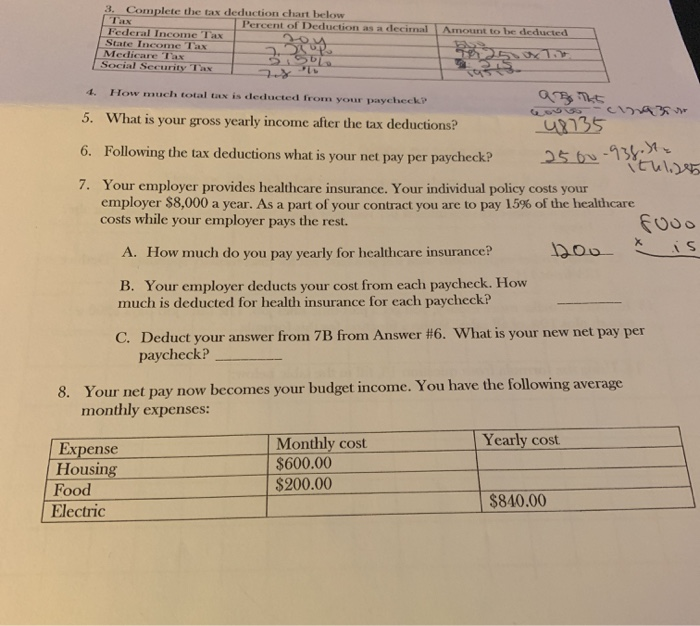

3 Complete The Tax Deduction Chart Below Percent Of Chegg Com

How much are taxes in SC.

. The payer has to deduct an amount of tax based on the rules prescribed by the. The Georgia tax code has six different income tax brackets based on the amount of taxable income. The mentioned tax has a limit of 147000 earned in the year.

Use the Georgia salary calculator to see the impact of income tax on your paycheck. Divide the sum of all assessed taxes by the employees gross pay to determine the percentage of taxes deducted from a paycheck. This marginal tax rate means that your.

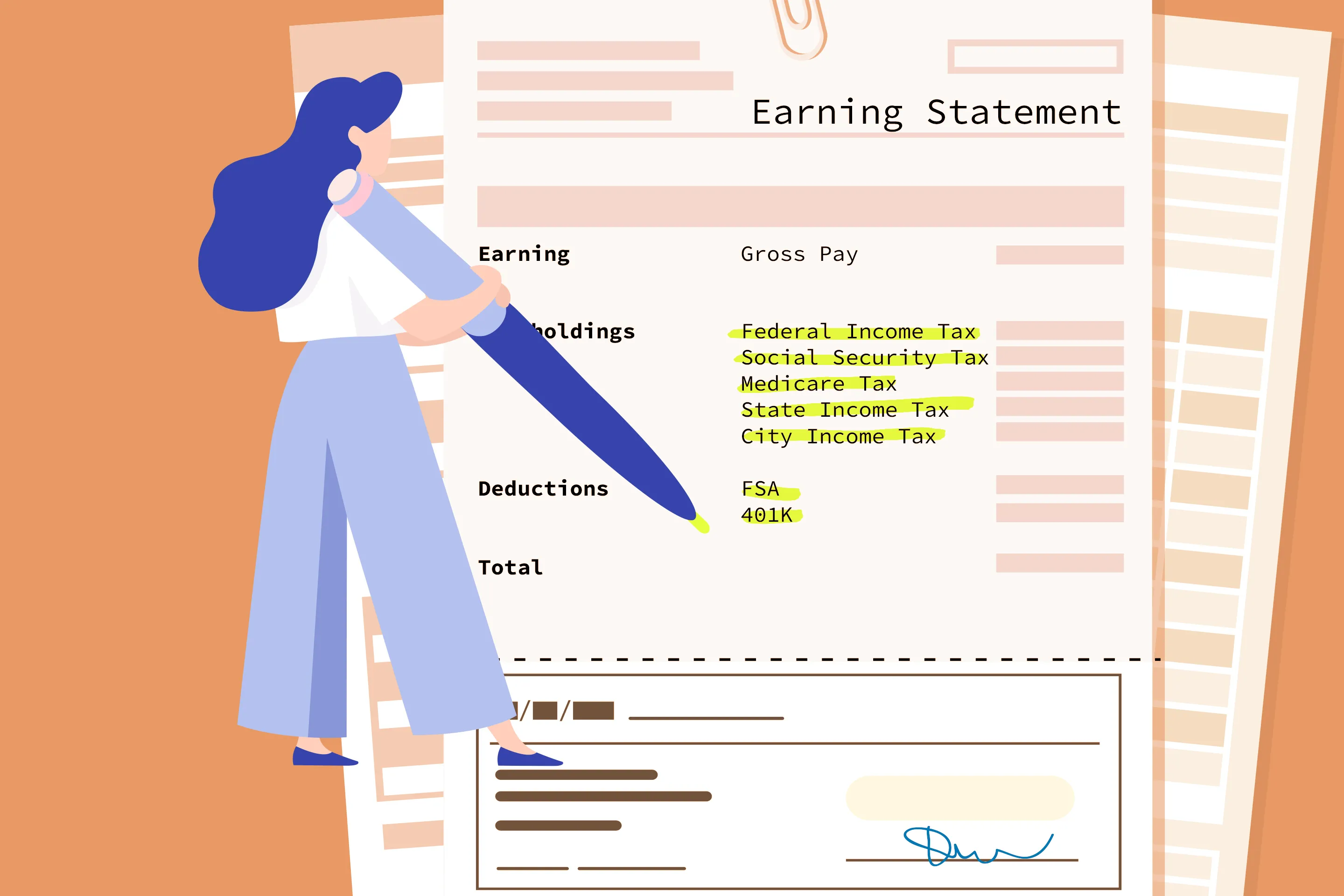

If you can be claimed as a dependent on another persons tax return your 2023 standard deduction is limited to the greater of 1250 or your earned income plus 400 the. These amounts are paid by both employees and employers. There are no income limits for Medicare tax so all covered wages are subject to Medicare tax.

This cap applies to state income taxes. How Is Tax Deducted From Salary. 252 on median income of 81868.

247 on median income of 59393. In addition the standard deduction will rise to 13850 for single filers for the 2023 tax year from 12950 the previous year. Federal income tax and FICA tax.

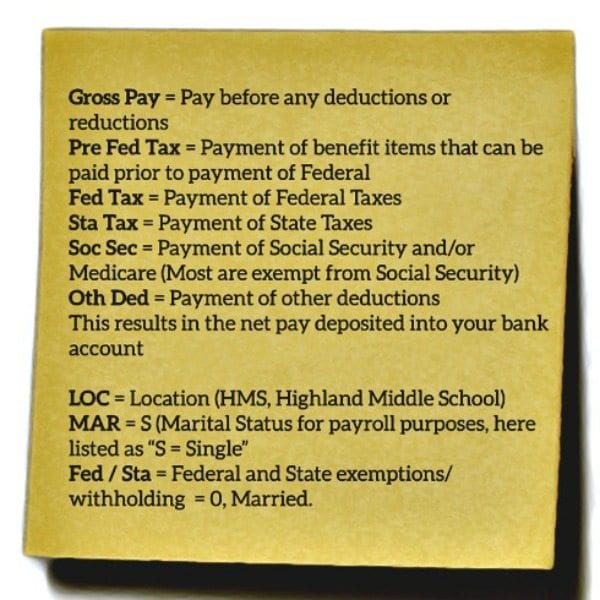

The Internal Revenue Service announced Wednesday higher federal income tax brackets and standard deductions for next year which will be a welcomed cost of living. That includes overtime bonuses commissions. How Your Paycheck Works.

Divide the sum of all assessed taxes by the employees gross pay to determine the percentage of taxes deducted from a paycheck. Paycheck Tax Calculator. For 2022 employees will pay 62 in Social Security on the.

The Social Security tax is 62 percent of your total pay until you reach an annual income threshold. The deduction for state and local taxes is no longer unlimited. With it the worker is deducted 62 of their gross paycheck.

Taxes can include FICA taxes Medicare and. Jan 12 2021 the tax rate is 6 of the first. 249 on median income of 77378.

In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare. In addition to federal income tax you will also have to pay state income tax and any other local income taxes like those for city or county governments.

The percentage rate for the Medicare tax is 145 percent although Congress can change it. The standard deduction for couples filing. Medicare tax is levied on all of your.

Estimate your federal income tax withholding. FICA taxes consist of Social Security and Medicare taxes. There are seven federal income tax rates in 2023.

Social Security tax and Medicare tax are two federal taxes deducted from your paycheck. Divide the sum of all assessed taxes by the employees gross pay to. State sales tax rates.

That is to say when workers have earned such an. See how your refund take-home pay or tax due are affected by withholding amount. At one time you could deduct as much as you paid in taxes but TCJA limits the SALT deduction to 10000 or just 5000 if youre married but file a separate tax return.

Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. FICA and State Insurance Taxes. If you want to boost your paycheck rather than find tax-advantaged deductions from it you can seek what are called supplemental wages.

Income tax calculator South Carolina Your average tax rate is 231 and your marginal tax rate is 367. For example in the tax. Do you pay taxes on your paycheck in Georgia.

For a hypothetical employee with 1500 in weekly. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. Use this tool to.

In October 2020 the IRS released the tax brackets for 2021.

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

Free Paycheck Calculator Hourly Salary Smartasset

Taxes Compensation Career Center University Of Southern California

2022 Federal State Payroll Tax Rates For Employers

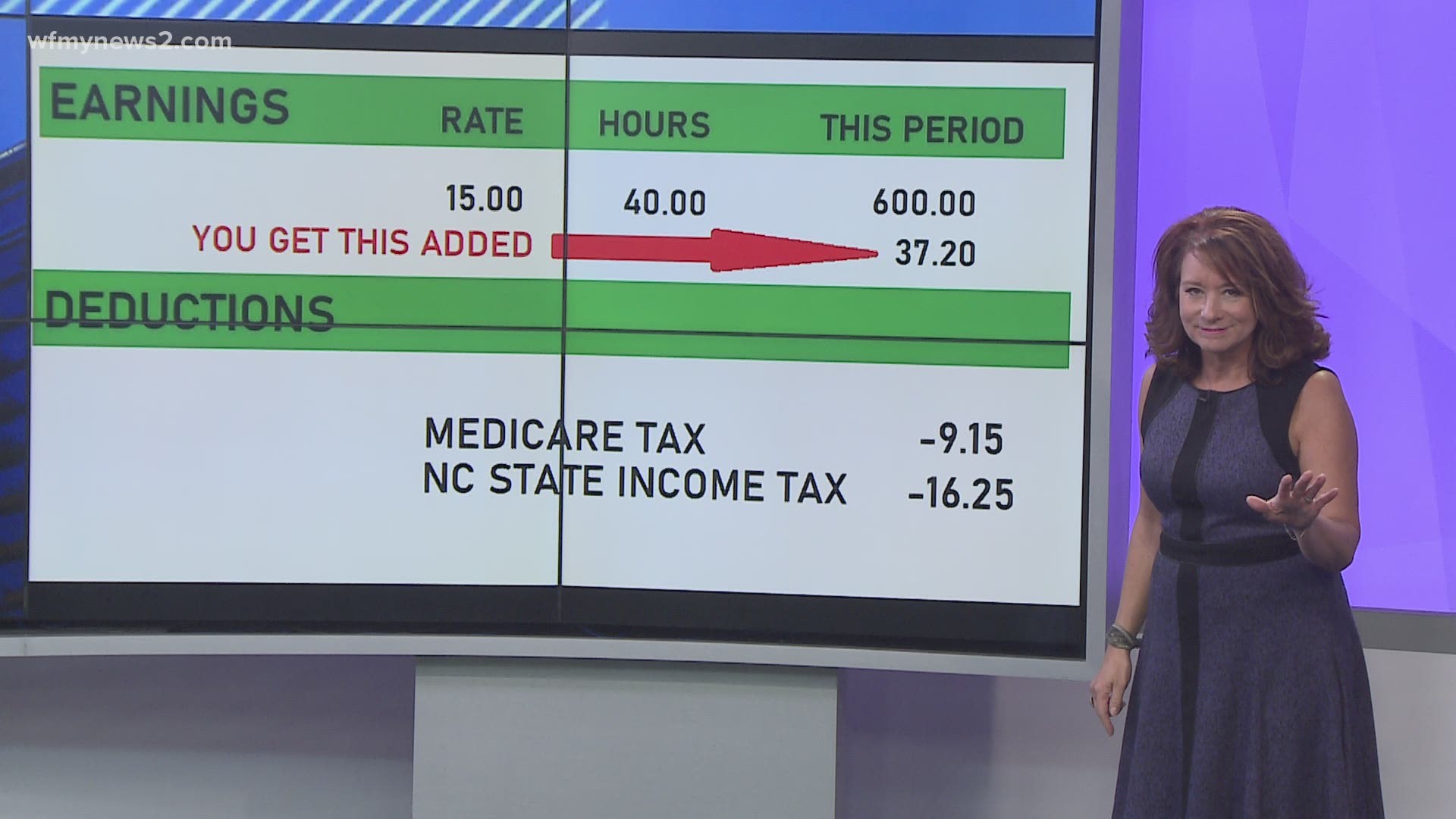

Understanding Your Teacher Paycheck We Are Teachers

Important Tax Information Work Travel Usa Interexchange

5 Tricks For Getting A Bigger Paycheck In 2021 Money

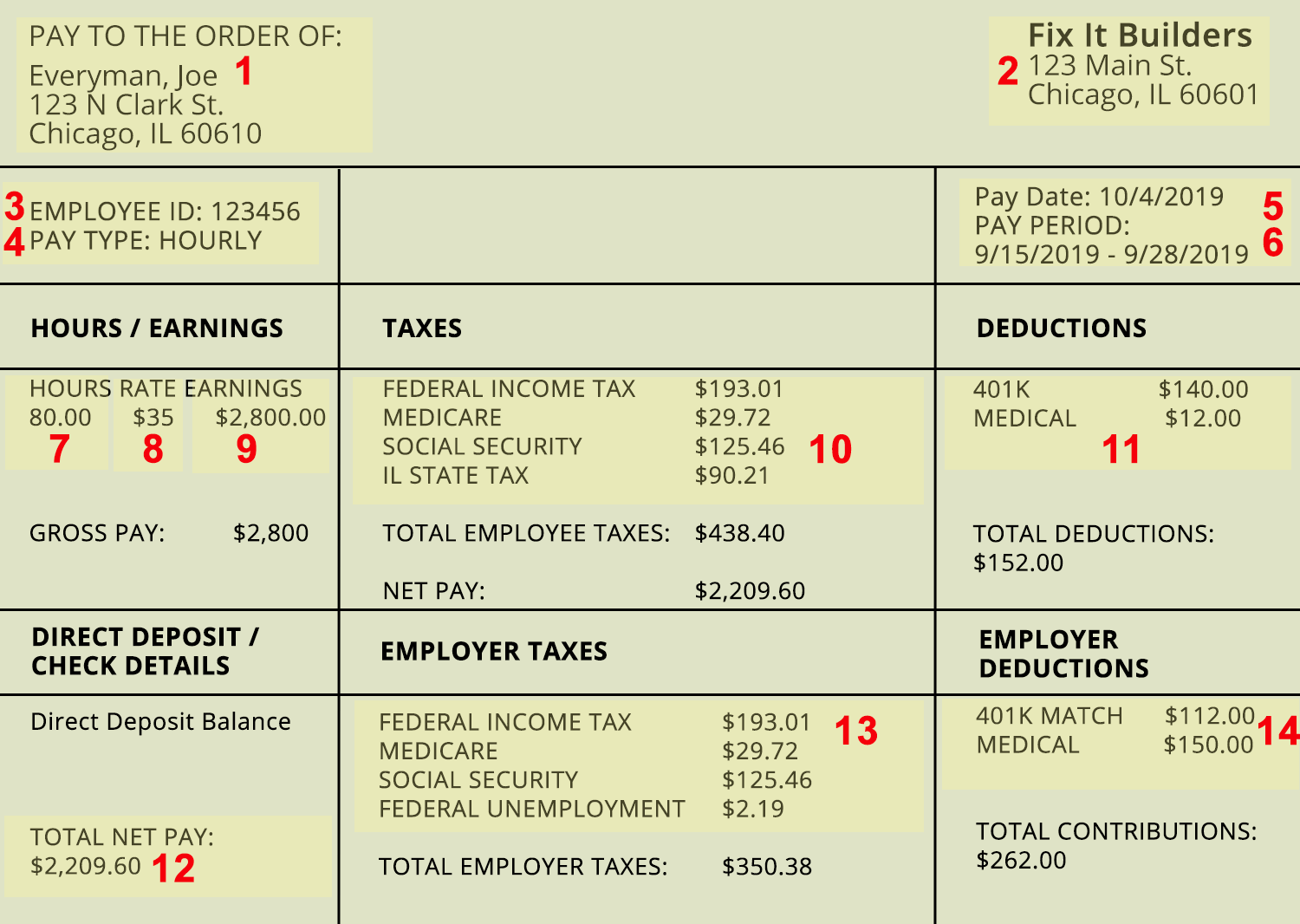

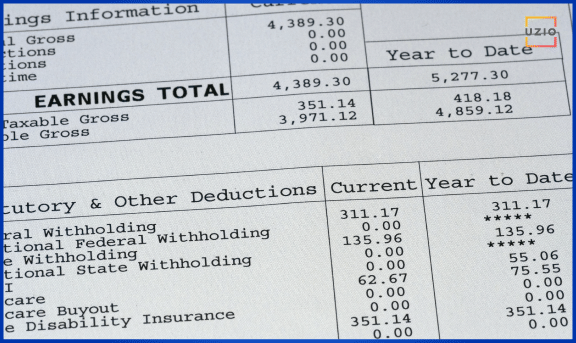

Anatomy Of A Paycheck Understanding Your Deductions Fidelity

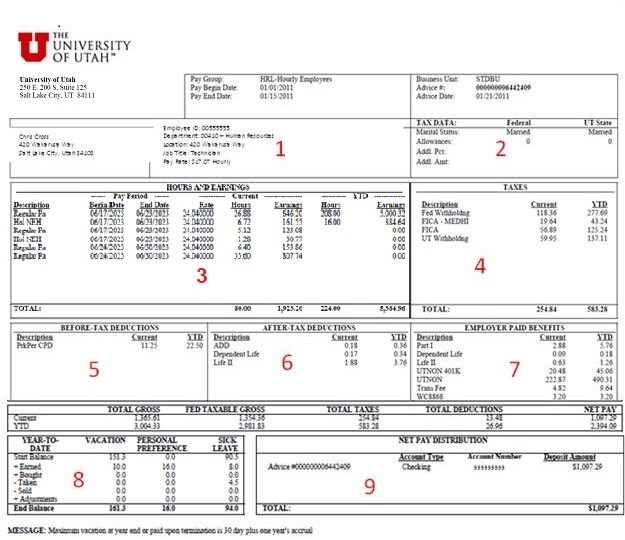

University Of Utah Human Resources

How To Read A Pay Stub Understanding Your Pay Stub Oppu

Where Does All Your Money Go Your Paycheck Explained

Us States Where The Most Taxes Are Taken Out Of Every Paycheck

The Payroll Tax Deferral Means Less Taxes Now More Taxes Later Wfmynews2 Com

Salary Paycheck Calculator How Do You Calculate Your Take Home Pay Marca

Paycheck Calculator Online For Per Pay Period Create W 4

What Does A Pay Stub Look Like Uzio Inc

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

Your Pay Stub Portland State University

Sample Pay Check And Fica Taxes Savings For Cpt Opt Studetns