iowa inheritance tax rates 2020

On the west by the Delaware River and Pennsylvania. Follow the IRM 2153463 No Consideration.

State Individual Income Tax Rates And Brackets Tax Foundation

In fact recent data from the Federal Reserve found in the first quarter of 2020 the average credit card rates was 1661 percent while the average interest rate for a 24-month personal loan was.

. First transfers of up to as of 2020 15000 per recipient person per year are not subject to the tax. New Jersey Division of Taxation 2020. However most countries have inheritance tax at similar or higher rates.

The program will feature the breadth power and journalism of rotating Fox News anchors reporters and producers. And Oregon implemented a new modified gross receipts tax in 2020. Inheritance Tax Rates New York State Department of Taxation and Finance 2021.

Iowa inheritance Tax Rate B 2020 Up to 12500 5. There are two levels of exemption from the gift tax. Other states with comparatively high corporate income tax rates are Iowa and Minnesota both at 98 percent Alaska 94 percent Maine 893.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. Abolished the state inheritance on December 31 2012. For any amended returns filed for tax years 2019 and prior follow normal adjustment procedures for decedent claims and if applicable issue manual refund.

In this example the indicator becomes effective on 1012020. To cut child poverty rates by half the majority of states would require a base credit value of between 3000 and 4500 per child plus a 20 percent boost for young children. This marginal tax rate means that.

Like many states Arkansas adopted both corporate and individual income tax rate reductions. The top rate in 2020 was 15 percent but a reduction of 40 percent brings the top rate to 9. Some states a state estate tax.

If the federal Child Tax Credit expansion is reinstated the same goals could be achieved through smaller state credits. A footnote in Microsofts submission to the UKs Competition and Markets Authority CMA has let slip the reason behind Call of Dutys absence from the Xbox Game Pass library. Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly opens in new tab and the 10 least tax-friendly states for retirees.

Inheritance is exempt if passed to a surviving spouse parents or grandparents or to children grandchildren or other lineal descendants. For each of these years effective tax rates stood at 112 percent of net national product higher than all years in our series except the first two for which. Rising to 114 million for 2019 1158 million for 2020 117 million for 2021 1206 million for 2022 and 1292 million for 2023.

The result is tax collections increasing faster than income growth yielding higher overall burdens in 2020-2022 despite more states cutting tax rates than raising them in recent years. Full Weight 500 Points Note. Additionally the state has a particularly aggressive treatment of international income levies an inheritance tax.

New Jersey is a state in the Mid-Atlantic and Northeastern regions of the United States. Those who have a checking or savings account but also use financial alternatives like check cashing services are considered underbanked. The highest individual income tax rate tops out at 765 in Wisconsin.

Other recipients are subject to inheritance tax with rates varying. This metric is based on WalletHubs States with the Highest Lowest Tax Rates ranking. Explore 2021 state estate tax rates and 2021 state inheritance tax rates.

Your average tax rate is 1198 and your marginal tax rate is 22. George Walker Bush born July 6 1946 is an American politician who served as the 43rd president of the United States from 2001 to 2009. Microsoft has responded to a list of concerns regarding its ongoing 68bn attempt to buy Activision Blizzard as raised by the UKs Competition and Markets Authority CMA and come up with an.

On the east southeast and south by the Atlantic Ocean. The tax rates on inheritances can be as low as 1 or as high as 20 of the value of property and cash you inherit. If a claim is filed for tax years 2020 or subsequent do not adjust the account.

A member of the Republican Party Bush family and son of the 41st president George H. It is bordered on the north and east by the state of New York. In Arkansass case these rate reductionsto a top individual income tax rate of 49 percent down from 59 percent and a corporate rate reduced from 62 to 59 percentwent into effect for the 2022 tax year.

The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing. And on the southwest by Delaware Bay and the state of DelawareAt 7354 square miles 19050 km 2 New Jersey is. Bush he previously served as the 46th governor of Texas from 1995 to 2000.

This metric measures taxation on retirement income property and purchases as well as special tax breaks for seniors. An inheritance tax is a tax paid by a person who inherits money or. Of course state laws are subject to change so if you are receiving an inheritance check with your states tax agency.

Wisconsin The Badger State is sure to pester its wealthiest residents to pay up at tax time. FOX FILES combines in-depth news reporting from a variety of Fox News on-air talent. Full Weight 500 Points Note.

Five states Iowa Kentucky Nebraska New Jersey and Pennsylvania impose only inheritance taxes. However as the exemption increases the minimum tax rate also increases. The underbanked represented 14 of US.

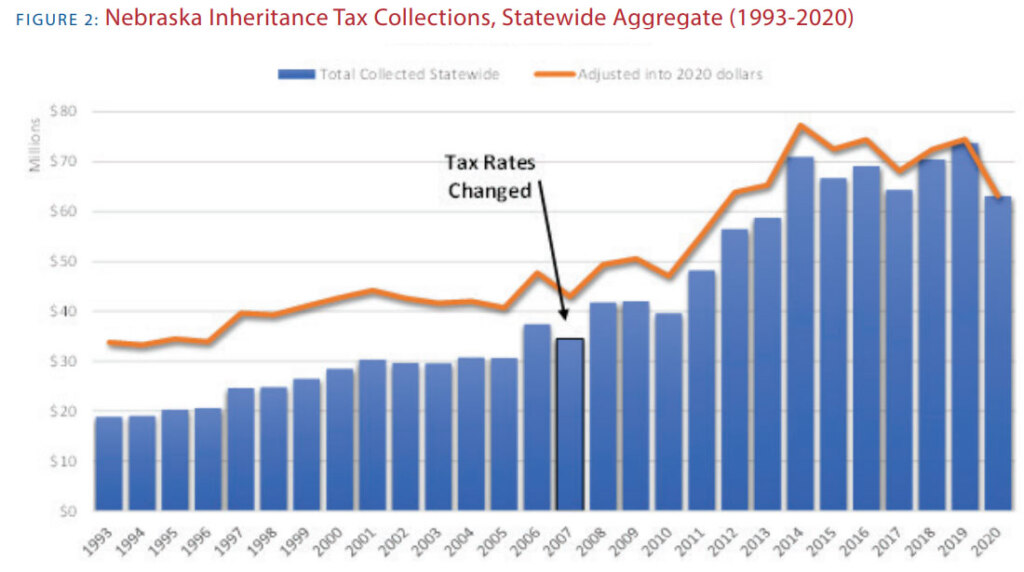

Federal Estate Tax Rates. In a graph posted at Microsofts Activision Blizzard acquisition site the company depicts the entire gaming market as worth 165 billion in 2020 with consoles making up 33 billion 20 percent. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the baseline rates until 2025 when the tax will be fully eliminated.

To make things simple if your estate is worth 1206 million or less you dont need to worry about the federal estate tax. The six states that impose an inheritance tax are. While in his twenties Bush flew warplanes in the Texas Air National.

These rates are for the 2020 tax year the year for which returns are due this spring according to the Tax Foundation. If you make 70000 a year living in the region of New York USA you will be taxed 12312. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

Death And Taxes Nebraska S Inheritance Tax

Where Not To Die In 2022 The Greediest Death Tax States

Iowa Lawmakers Pass Massive Tax Cut Iowa Capital Dispatch

How Do State Estate And Inheritance Taxes Work Tax Policy Center

The Truth About Inheritance Tax Updated 2020 Trust Will

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

Another State Ditches Its Death Tax While Potential Backdoor Federal Estate Tax Looms

Iowa Inheritance Tax Rates Fill Online Printable Fillable Blank Pdffiller

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Tax Talk Iowa S Inheritance Tax Gordon Fischer Law Firm

Tax Talk If You Die In Iowa Is There A State Estate Tax Gordon Fischer Law Firm

Iowa Inheritance Tax Rate Schedule Fill Out Sign Online Dochub

Colorado Estate Tax Do I Need To Worry Brestel Bucar

A Guide To The Federal Estate Tax For 2022 And 2023 Smartasset

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Iowa Legislature Passes Bill To Cut Income Inheritance And Property Taxes

Another State Ditches Its Death Tax While Potential Backdoor Federal Estate Tax Looms

:max_bytes(150000):strip_icc()/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png)